Generally speaking and based on the statistics published by the Department of Lands and Surveys, 2020 started with a general slight decline for the Cypriot real estate market. Figures in 2019 were at their zenith and, under market laws, this slight drop was expected. Moreover, there was yet another decline in the regard of foreign investors, during the first two months, but this in no way foreshadowed the prices noted since March 2020.

The cause is not only familiar but also all too common with what the entire global real estate market has been facing, and concerns none other than the emergence of Covid-19, its subsequent lockdown, and containment measures– which to date have not been lifted entirely. In the Cypriot real estate market, significant financial figures in monetary amounts and purchases were noted by foreign investors, whether they came from European Union countries or from third parties. Their withdrawal from the domestic market has created a large gap as, up until today and even henceforth, any move concerns – primarily – Cypriot citizens with smaller economic agreements.

Click here to get the best Cyprus Real Estate

Statistics and comments

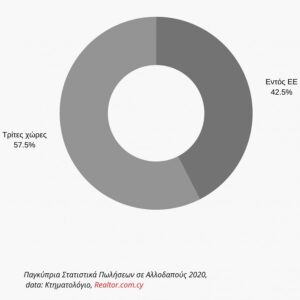

Indeed, even in August, when the statistics from the above service become published, the number of foreign buyers totals 1,943, of which 825 are from the Member States of the European Union and 1,118 are from third countries.

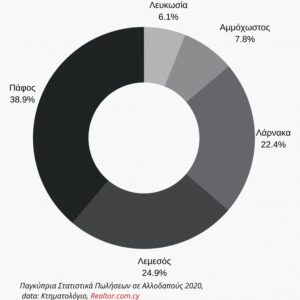

The maximum number of foreign buyers was 91 and was recorded in Paphos for the month of February, while the lowest was recorded at 0, in Larnaca– also in February. The largest percentage was collected by Paphos with a crowd of 755 (of which 396 were within the EU and 359 from third party countries). The remaining provinces and their corresponding numbers were recorded as follows: Limassol totals at 483 (164 within the EU, and 319 in third parties), Larnaca at 436 (109 within the EU, and 327 third parties), Famagusta 151 (82 within the EU and 69 third parties) and finally Nicosia at 118 (74 within the EU and 44 third parties). The result concludes that more interest was shown by buyers from third countries culminating in the province of Paphos, which recorded a crowd of 359 buyers (the corresponding maximum number for buyers from EU countries was 396 and was also recorded in Paphos).

The chart below shows the relationship of the provinces with each other, regarding the total number of foreign buyers.

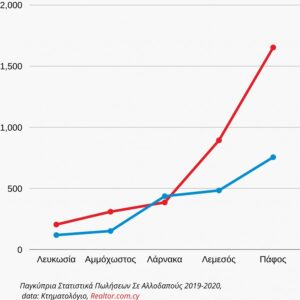

Following the image of foreign investors, as was presented last year and concerned only the period between January and August, Paphos continues to be first in their preferences (for 2019, the corresponding period, Paphos attracted the interest of a total of 1,653 foreigners, of which 893 came from EU Member States and 760 from third countries).

Comparing the periods January – August of the years 2019 and 2020, there is undoubtedly a significant drop for the current year. As can be seen from the diagram below, the exception is the province of Larnaca, which in 2020 attracted the interest of 51 more foreign buyers than in the corresponding period of 2019 (additional interest comes from third party foreign buyers).

The diagram below shows the total number of foreign buyers by province. The red line refers to the year 2019 and blue to 2020.

Last quarter 2020

After the definitive lifting of measures and restrictions, the strict criteria for the Cyprus Investment Plan (Naturalisation Plan) seem to provoke a particular interest in the real estate market and how it will evolve. Chinese, Russian and Arab investors, and entrepreneurs flooded the Cypriot market with real estate investments because of the coveted Cypriot passport, which would have given them easier access to global markets.

The chain of global economic developments, combined with that of the Cypriot economy, will also shape the purchase of the real estate by foreign buyers for the last four months of this current year. In this development, tax incentives will count as additional factors, as will the Naturalisation Plan and other Government Plans, in order to establish the full economic valuation of the market in the real estate sector by the end of the year.

Click here to contact the best Rent in Nicosia

Important Note: The upper text was created for informational purposes. Republishing, broadcasting, transferring, reproduction, retransmission, distribution, presentation, resale, or any other use or reference is PROHIBITED, even if the creator of the text itself or the blog itself is mentioned as the source.